A hot-off-the-presses report from the Medicare Payment Advisory Commission (MedPAC) finds plenty of excessive Medicare spending for Congress to cut—in large part because the program sets excessive prices for health insurance (as it does for everything else).

Traditional Medicare sets and pays hundreds of thousands of prices for separate goods and services. MedPAC has long documented excessive prices for specialty care, skilled nursing facilities, cataract removal, evaluation and management visits, et cetera, ad nauseam.…

MedPAC’s latest report shows Medicare performs no better when it sets and pays prices for private health insurance. More than half of Medicare enrollees now choose to get their Medicare subsidy through private insurers via the Medicare Advantage program. Unlike traditional Medicare, Medicare Advantage sets and pays a single price for each enrollee: the total premium that an insurer receives for covering that enrollee.

MedPAC finds:

Both favorable selection and coding intensity lead to pricing errors that cause [Medicare] to set the payment rate too high for a given [Medicare Advantage] enrollee.

(I would say that selection and upcoding reflect government mispricing errors, but you get the idea.)

Those pricing errors are significant:

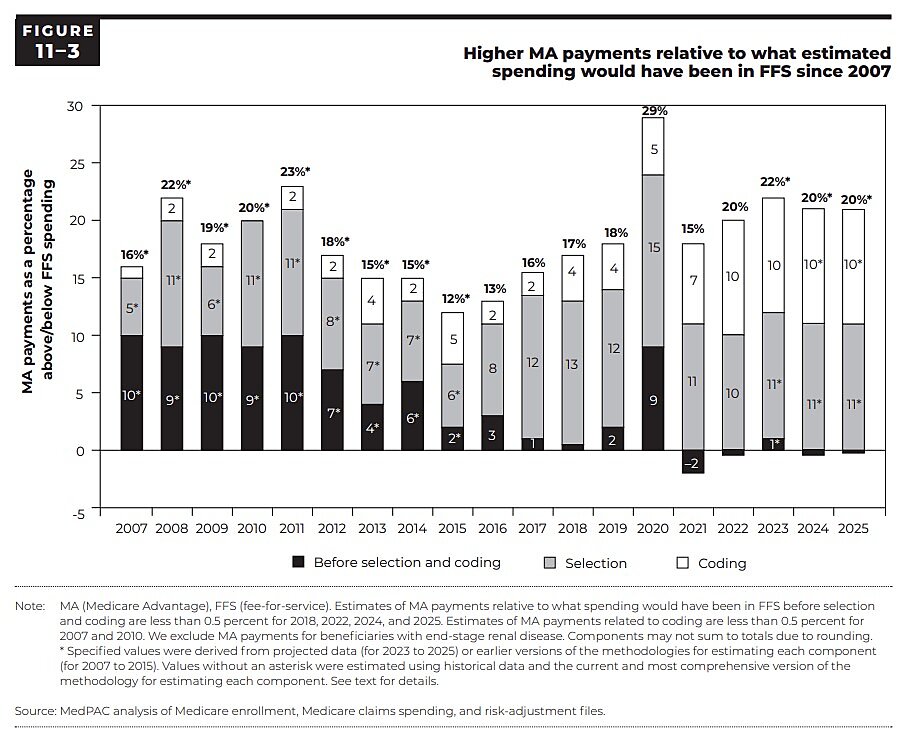

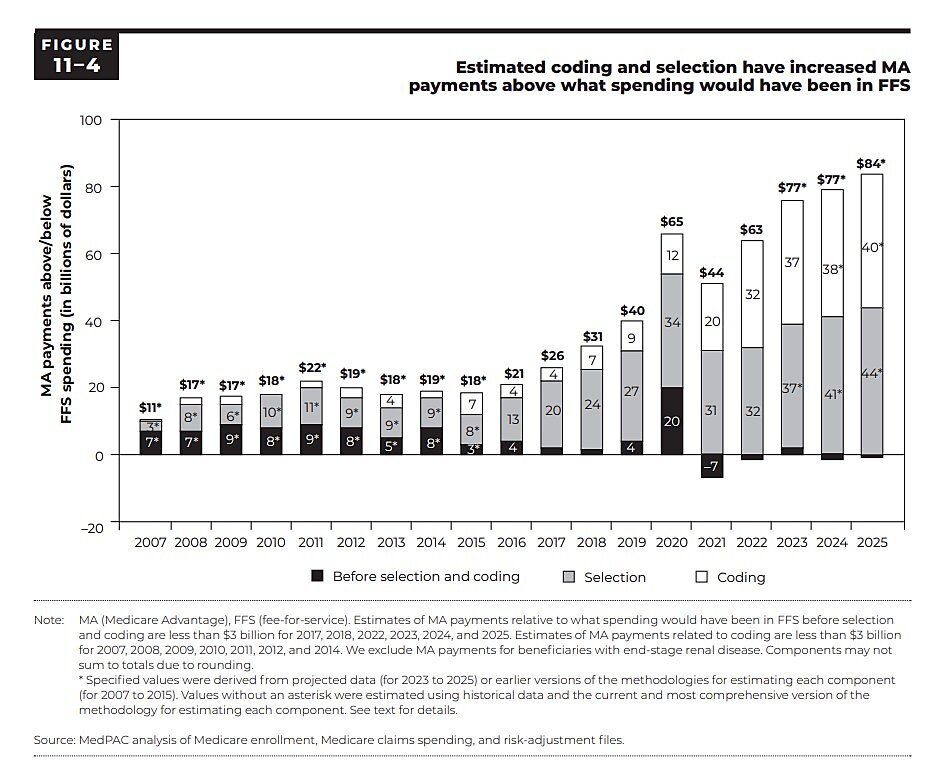

In 2025, we estimate that Medicare will spend about 20 percent more for MA enrollees than it would spend if those beneficiaries were enrolled in FFS Medicare, a difference that translates into a projected $84 billion.

This figure shows how this “Medicare Advantage markup” (my words, not MedPAC’s) has grown over time:

The excess burden that Medicare Advantage imposes on taxpayers has exploded by 400 percent over the past decade.

Indeed, all that extra spending is why Medicare Advantage enrollment has exploded. Switchers know that on average they’ll get a 20-percent-larger subsidy than they would in traditional Medicare.

How do they know? Medicare Advantage plans compete to capture that $84 billion by offering “nonmedical supplemental benefits” that differentially appeal to relatively healthy enrollees, whom insurers know will cost less than the government is paying. You know, stuff like “nonemergency transportation services, assistance paying for over-the-counter items, meals, and gym memberships.” Your tax dollars are even paying private health insurance companies to offer groceries, hair care, pet care, complementary therapies, and structural home improvements.

Medicare Advantage has its defenders, including private insurers and the least-needy Medicare enrollees. Why wouldn’t they defend this gravy train? Then there are Republicans, who (for some reason) reflexively defend government-enlarging subsidies for private insurers.

Unfortunately, the only defense they offer—that all that excess spending buys better health care—does not hold water. MedPAC surveyed the literature on whether that’s true. They found lots of conflicting studies and determined the evidence was “inconclusive.” So there are plenty of studies for Medicare Advantage apologists to cherry-pick. But the more likely explanation is that they have other reasons for defending $84 billion in excessive spending. Like, they’re profiting from it. Or, they’re afraid to offend the politically powerful special interests who are.

But surely, Republicans can cut Medicare subsidies for gym memberships and pet care.